Educational resources for helping you develop financial skills.

A Q&A about everyday situations and tips related to money.

Invest in Yourself

Money Talks feat. Tierra Whack

Season 2

The concept of the traditional 9-5 is evolving. With more opportunities available, many are transforming side hustles into full-time gigs and becoming their own boss, learning about the way they work in the process. Setting yourself on the path to success, however, can be tricky.

Here are some things to keep in mind if you’re ready to transform your side gig into a full-blown business.

This content reflects the real-life experiences of individuals. Participants received compensation for sharing their stories. Venmo is not making any recommendations regarding finances. Consider seeking advice from your financial advisor.

Finding the right direction.

Beyond day-to-day plans, what’s your overall strategy? How will you track finances? Do you know where your business stands in the community vs. the competition? Stepping up to a bigger operation may also require a bigger vision.

Take time to define your goals and long-term plan. Think about what you want to achieve in your personal and professional life, and whether each step helps you get there. For example, your mindset and approach to budgeting may be different if you’re looking to build savings than if you just need to cover monthly or day-to-day expenses.

With these choices, you can start to get a clearer view of what you want, how to get it, and the time and money required to support yourself while going after your goals.

Go at your own pace.

Day jobs can be a vital source of income as you expand your side hustle, and even provide opportunities to network or develop relevant skills. The budget for your business isn’t coming out of thin air—rent, bills, and other essentials still need to be paid for.

Everyone’s situation and strategy is different. But whether you left your day job behind to focus on developing a side hustle or are tackling it in your off-hours, there’s still risk and personal investment required. Follow your comfort zone and you may avoid additional stress that can get in the way of your goals.

Growth can happen as quickly or as slowly as you need it, so don’t be afraid to invest more time and money as the business expands and you become more confident.

Did you know?

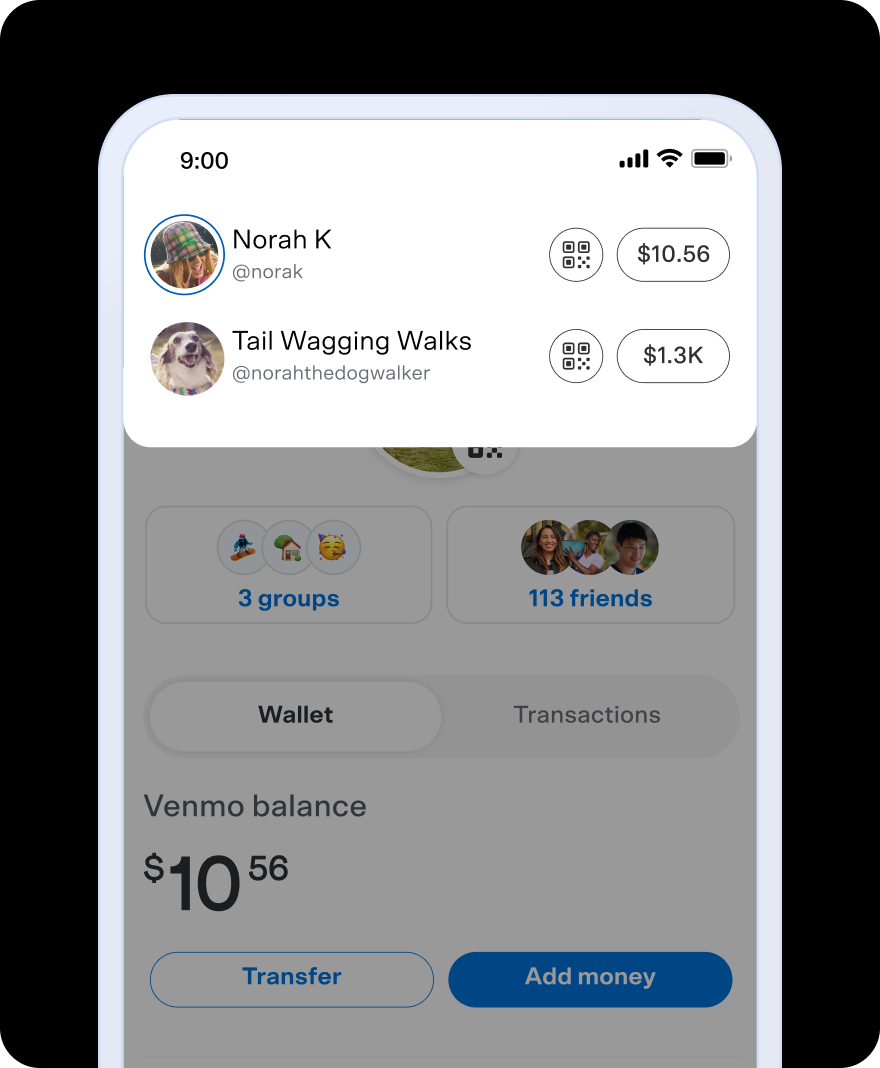

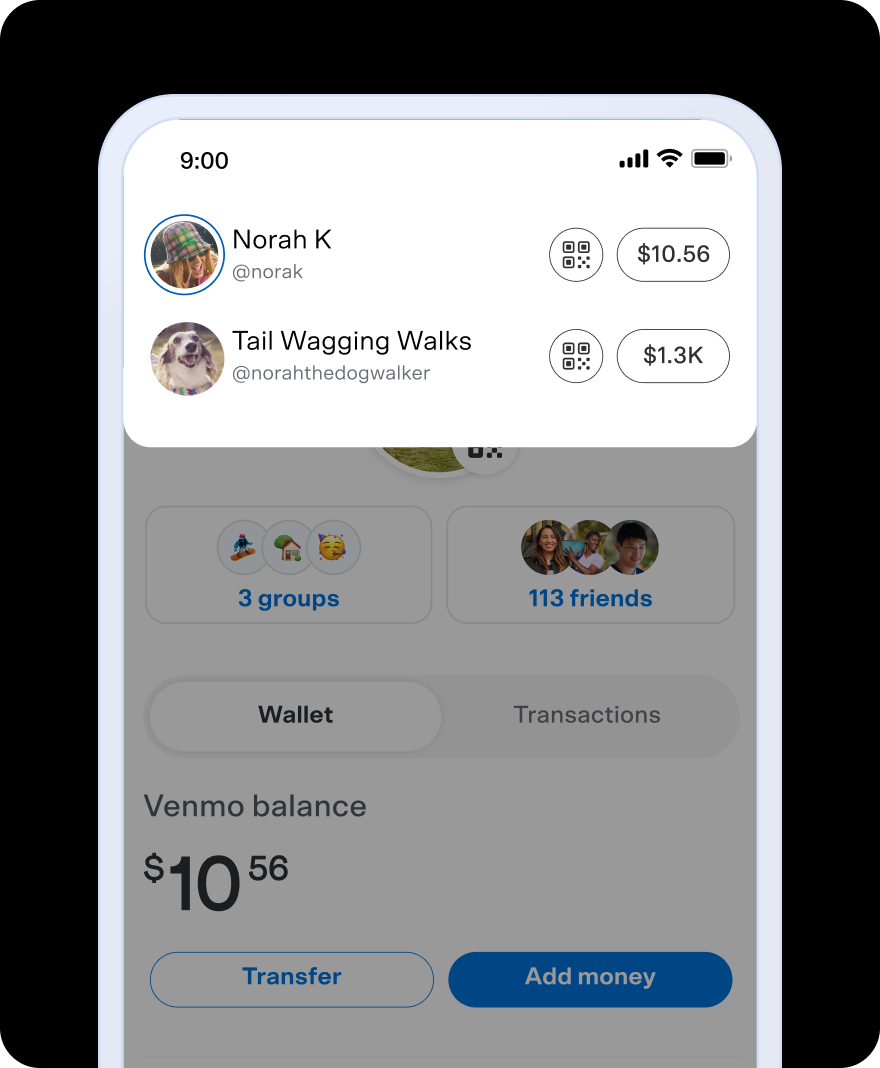

A Venmo Business Profile lets you manage customer and personal transactions from the same app, helping you keep your eye on overall spending and make financial decisions with ease.

Market and make connections.

Now that you’re in business, it helps to make a name for yourself. This means finding customers, like-minded businesspeople, and building a network.

A website and social media presence can be essential, but so is getting out in your community. Establishing in-person connections with potential customers can be the key to winning their sales and long-term support. It can also help you get to know more about them and find opportunities to expand. If your business doesn’t support in-person meetings, think about other ways you can show up through local events or volunteer efforts.

You might meet other side hustlers on the same journey as you. Don’t worry––not everyone is business competition. These connections can become vital in developing your own knowledge and skills. With the right fit, they could even become partners in the next step of your journey.

Related content

Season 1

Feat. Cordae

Budgeting Your Money

Everyone approaches money differently. Join us as we talk about personal spending and building better habits.

Looking for more?

Explore a Q&A with financial experts and more on our YouTube channel. Follow along and you’ll be notified when new content drops.

Get the

Venmo app.